Before you start reading, here are the bullet points:

In an ideal world, most of us would prefer to steer clear of the intricacies of tax laws, especially when it comes to our businesses. Yet, in today’s increasingly complex financial landscape, grasping the tax regulations that pertain to our entrepreneurial endeavors has become more crucial than ever. It’s not merely a matter of complying with the legal requirements; it’s about discovering the numerous advantages that can be leveraged to save money – money that can be strategically reinvested to fuel the growth of our businesses. In this article, we embark on a journey through the often-bewildering terrain of tax laws, shedding light on one particularly noteworthy provision in both Canada and the US: Expansion of the Eligibility of for Tax Support for Business Investments and Section 179 of the IRS Tax Code. We’ll also delve into the recent expansion of eligibility criteria for tax support, highlighting how these changes can be a game-changer for business investments.

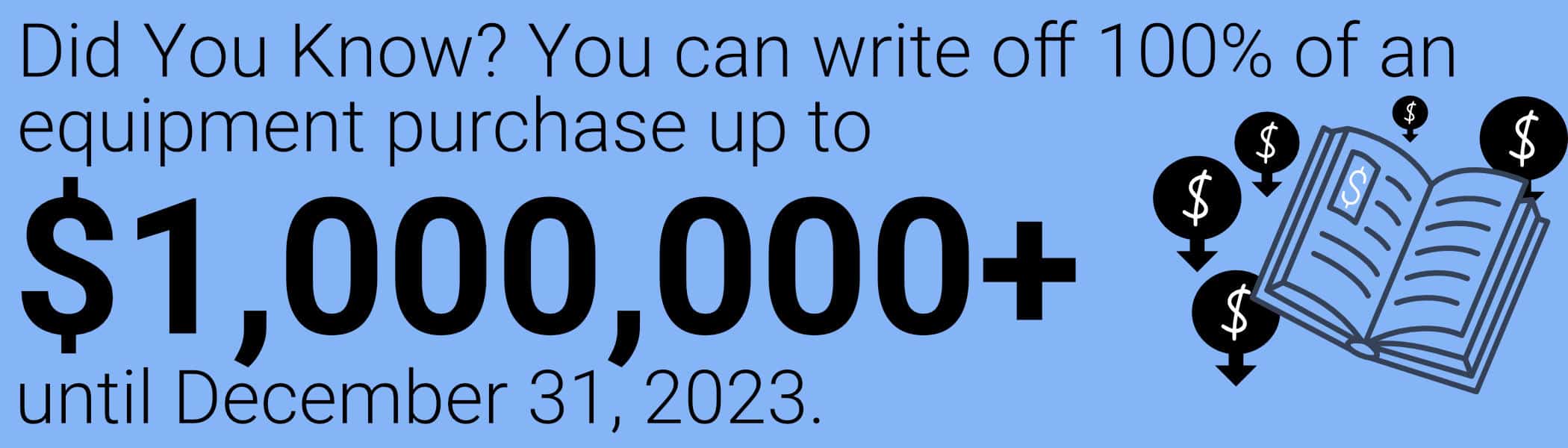

Navigating the ever-evolving tax landscape may seem like a daunting task, but by understanding the nuances and its implications for entrepreneurs, you can unlock a host of opportunities to bolster business. So, whether you’re a seasoned owner or just starting out, join us as we demystify this essential tax code and explore how it can help you not only meet your financial obligations but also supercharge your business ambitions. As both of these measures are only valid until the end of the fiscal year (December 31st, 2023), it is important to see how you can utilize them while they are still available.

Section 179 of the IRS Tax Code is a valuable provision that offers significant benefits to business owners who are investing in equipment and assets. Here’s a breakdown of what Section 179 means for business owners purchasing equipment:

Accelerated Depreciation

Section 179 allows business owners to deduct the full cost of qualifying equipment and assets from their taxable income in the year they are placed into service, rather than depreciating the cost over several years. This means you can potentially write off the entire purchase price of eligible equipment in the same year you acquire it, providing an immediate boost to your cash flow.

Eligible Equipment

Many types of tangible business property qualify for Section 179 deductions, including machinery, vehicles, computers, office furniture, and more. The key is that the equipment must be used for business purposes at least 50% of the time.

Deduction Limit

While Section 179 offers generous deductions, there are limits to how much you can deduct in a given tax year. In 2023, the limit has been set at $1,160,000. However, it’s essential to check the current limits as they may change over time. Additionally, there’s a phase-out threshold, which means that the deduction begins to decrease once the total equipment purchases for the tax year exceed a certain threshold.

However, in order to spur investment, the US government has made any qualifying purchase of equipment and/or software to be fully deducted in the first year, rather than the usual multi-year pathway of depreciation. This means that you can deduct the full purchase price from your gross income!

Qualifying Businesses

Section 179 is primarily designed to benefit small and medium-sized businesses. To take advantage of this provision, your business must have a certain amount of qualified equipment purchases for the tax year, and the deduction cannot exceed your taxable income.

Benefits for Cash Flow and Growth

Section 179 can have a significant impact on your business’s cash flow. By writing off equipment costs immediately, you reduce your taxable income, which can lead to lower tax payments. This, in turn, frees up more capital that you can reinvest in your business for expansion, upgrades, or additional equipment purchases.

Keep Records

It’s crucial to maintain accurate records of equipment purchases, including invoices and receipts, to substantiate your Section 179 deduction claims in case of an IRS audit.

In summary, Section 179 of the tax code is a valuable tool for business owners looking to invest in equipment and assets. It allows for accelerated depreciation, immediate tax deductions, and improved cash flow, ultimately supporting business growth and financial stability. However, it’s essential to consult with a tax professional or accountant to ensure you meet all the eligibility criteria and maximize the benefits of this provision based on your specific circumstances and the most current tax laws.

Immediate Expensing

The government is proposing a temporary rule that allows certain Canadian companies to immediately write off the cost of certain property they buy, up to $1.5 million per year. This rule is in effect from April 19, 2021, to December 31, 2023. If a company buys something eligible, they can deduct its full cost from their taxes in the year they start using it.

Limits and Sharing

If a group of related companies buy eligible equipment, they need to share the $1.5 million limit. If a company’s tax year is shorter than a full year, the limit is adjusted. There’s also a special rule for how to handle property that’s not used for a whole year. If a company’s eligible property costs less than $1.5 million, they can’t save the unused limit for later years.

Eligible Property

The property that qualifies for this immediate write-off includes most types of property except for certain long-lasting assets.

Exceeding the Limit

If a company buys more eligible property than the $1.5 million limit, they can choose which category the immediate write-off goes to, and the rest is subject to regular tax rules. Other tax breaks for things like machinery or clean energy don’t reduce this $1.5 million limit, and it doesn’t change how much you can write off over the property’s lifetime.

Expanding Eligibility

The government is also proposing to extend this $1.5 million immediate write-off to individuals and certain partnerships who invest in eligible property. This applies to investments made after January 1, 2022, and before 2025 for individuals and eligible partnerships, and before 2024 for other partnerships. There are rules to make sure everyone follows the $1.5 million limit.

Technical Amendment

When you sell property that you’ve written off, you usually have to include the money you get from the sale in your income. But if you have a negative balance in a certain category, you also have to include that negative amount in your income. Likewise, if you have a positive balance but no property left in that category, you can subtract that positive amount from your income. This doesn’t apply to certain types of vehicles.

Special Rule for Vehicles

Just like in 2019 when they introduced an immediate write-off for zero-emission vehicles, they’re doing something similar for regular passenger vehicles. If you’re going to immediately write off a passenger vehicle, they have a special rule to figure out how much to include in your income when you sell it. This rule is effective for vehicles bought on or after January 1, 2022, and it ensures you don’t get too many tax benefits from this immediate write-off.

In essence, the government is offering a tax break that allows certain businesses and individuals to deduct the full cost of certain property they buy, up to a limit, right away instead of spreading it over time for tax purposes.

For a surveyor, the implications of Section 179 of the IRS Tax Code and the Canadian government’s immediate expensing rule can be significant, depending on their location and tax circumstances.

In the United States, Section 179 allows surveying businesses to potentially deduct the full cost of qualifying equipment, such as surveying instruments, GPS devices, computers, and vehicles, in the year they are placed into service. This can be a substantial financial benefit, as it provides an immediate boost to cash flow and reduces taxable income. Surveying equipment can be expensive, and being able to deduct these costs upfront can help surveyors invest in better equipment or allocate funds for other business needs. However, it’s important for surveyors to ensure that their equipment usage aligns with the business purposes required by Section 179 to qualify for the deduction.

In Canada, the immediate expensing rule can also benefit surveyors. If they are Canadian companies or individuals investing in eligible property like surveying equipment, they can immediately deduct the full cost from their taxes in the year they start using it, up to the specified limit. This can help surveyors in Canada reduce their taxable income and potentially reinvest in their businesses, upgrade equipment, or expand their operations. The eligibility criteria and limits should be carefully reviewed to ensure compliance and maximize the tax benefits.

In summary, both the U.S. Section 179 and the Canadian immediate expensing rule can provide surveyors with opportunities to improve their financial situations, reduce tax liabilities, and enhance their ability to invest in essential equipment. However, it’s crucial for surveyors in both countries to consult with tax professionals or accountants to understand the specific requirements, limits, and benefits of these tax provisions based on their unique circumstances.

Bench Mark Equipment & Supplies is your team to trust with all your surveying equipment. We have been providing high-quality surveying equipment to land surveyors, engineers, construction, airborne and resource professionals since 2002. This helps establish ourselves as the go-to team in Calgary, Canada, and the USA. Plus, we provide a wide selection of equipment, including global navigation satellite systems, RTK GPS equipment, GNSS receivers, and more. We strive to provide the highest level of customer care and service for everyone. To speak to one of our team today, call us at +1 (888) 286-3204 or email us at [email protected]

North America’s #1 supplier of land surveying equipment and instruments.