If you’re a land surveyor or construction professional eyeing a new RTK system or total station, you’re probably weighing the classic question: whether to purchase out right or lease your equipment? For many, especially small to mid-size firms, leasing equipment can offer major cash flow advantages—without compromising on access to top-tier tech.

Here’s what you need to know about leasing, using a real-world case study from one of our clients working with a GeoMax Zoom95 Robotic Total Station.

Real Numbers: A Leasing Example

Tax Benefits That Can Lower Your True Costs

Lease Advantages You Won’t Get from a Bank

Buying vs Leasing: What’s Best for Your Business Size

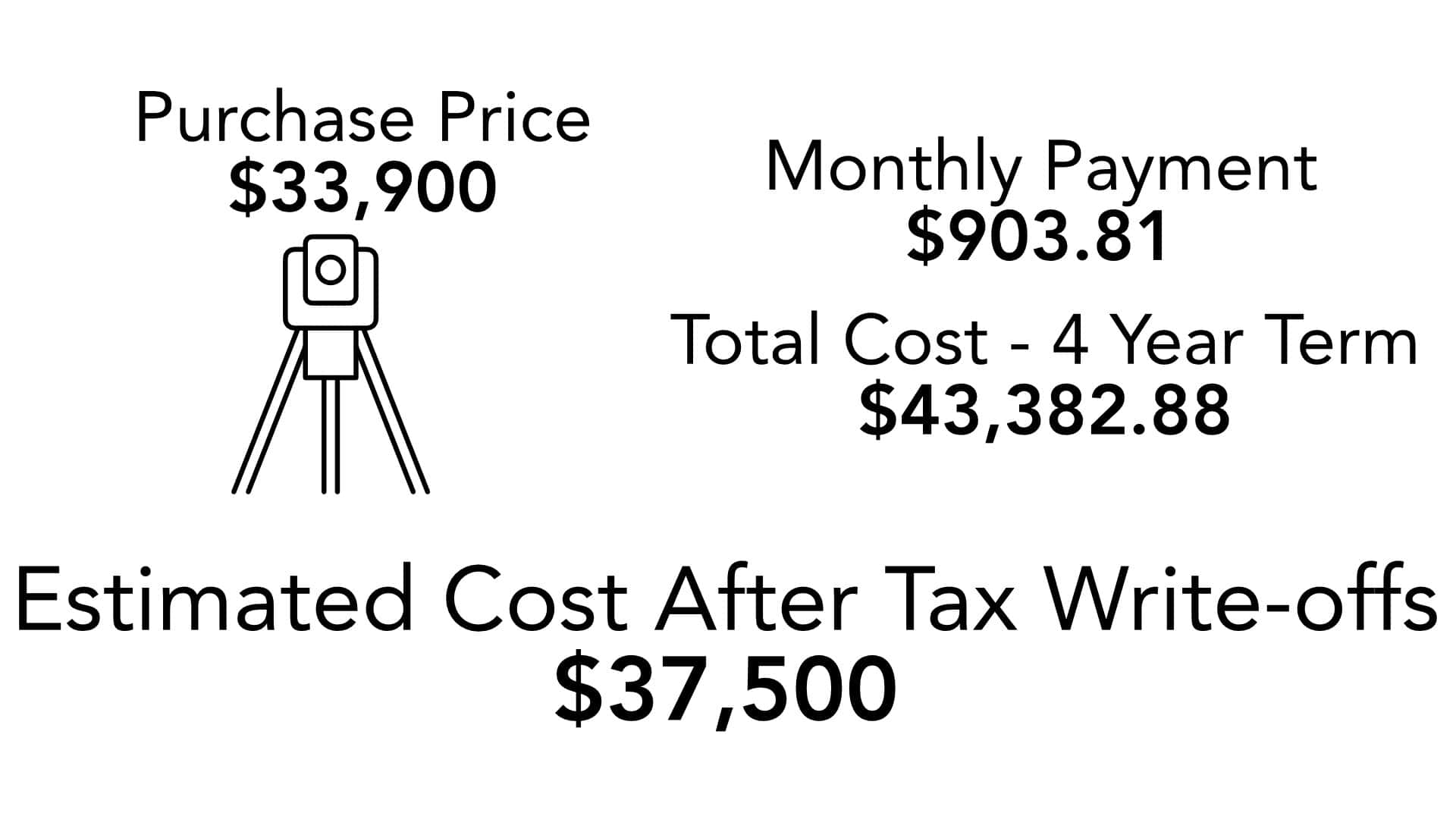

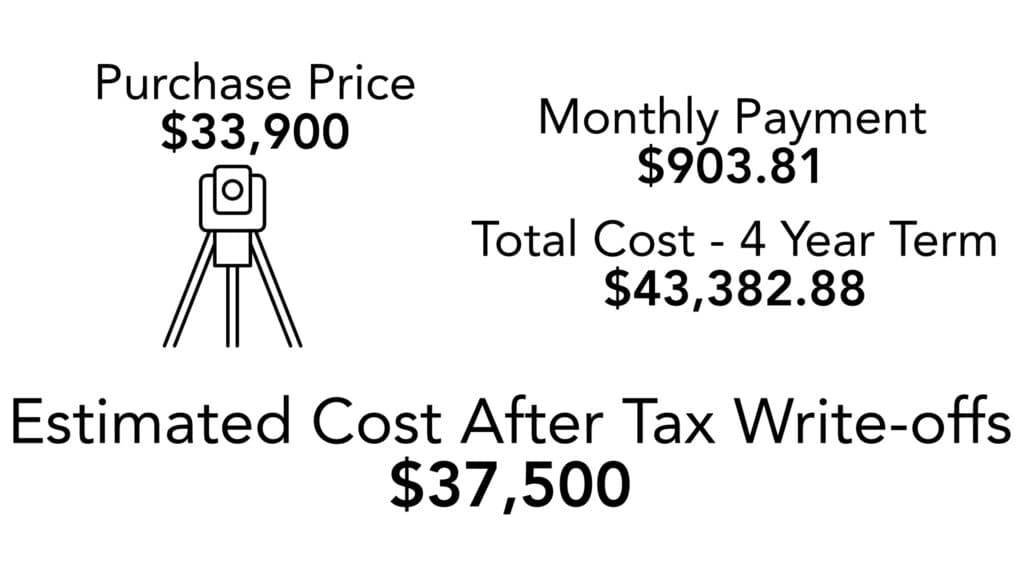

Let’s start with some actual numbers from a 48-month lease:

That last line’s important: unlike bank financing, commercial leases typically require a small upfront commitment, but not a massive down payment.

One of the biggest reasons to take a serious look at leasing is the advantages in tax efficiency.

Let’s break it down.

Say you’re paying $903.81/month. Over a year, that’s $10,845.72. If your business is in a 27% tax bracket (as a rough average), the tax write-off from that equipment payment would be approximately $2,928. That breaks down to $244/month in tax savings.

Now, if we assume a 50/50 split between interest and principal (a common, conservative estimate in lease structures), half of those payments are tax-deductible under lease treatment—including interest, and potentially more depending on how your accountant structures the write-offs.

The end result?

Your equivalent out-of-pocket interest rate, after tax savings, can be as low as 2.28%. That’s lower than many bank loans, and with fewer strings attached.

There’s more to leasing than just the rate.

1. It Doesn’t Affect Your Credit

Commercial leases don’t show up on your personal credit report. That means your borrowing capacity elsewhere remains untouched, giving you more flexibility when you need financing for other areas of your business.

2. No GSA (General Security Agreements)

With banks, loans are often secured against all your business assets—past, present, and future. Not ideal if you want to keep your equipment or capital unencumbered.

Leases don’t often require these same requirements. You maintain full control over your company’s other assets without needing to worry about something going wrong.

3. Flexible Buyout Options

Make 12 months of on-time payments? Many leases allow you the option to buy out your lease early—with interest discounts. You’re not locked in. That means if your cash situation improves, you can pay off the equipment and save even more.

4. Conserve Cash Flow

Let’s face it: writing a $30K+ cheque for gear up front can be a stretch, even for growing firms. With leasing, you can get the tools you need now, while keeping your monthly overhead predictable.

Leasing makes the most sense if:

Pros & Cons of Leasing

| Pros | Cons |

| Lower upfront cost | Higher total cost than cash purchase (before tax savings) |

| Tax write-offs help lower real cost | Must verify exact savings with your accountant |

| Doesn’t hit your credit report | Commitment for lease term unless buying out early |

| No GSAs on your assets | Requires timely monthly payments |

| Early buyout options available | Not ownership until lease ends or buyout is exercised |

Your decision to lease or buy often comes down to the size and structure of your business—and how you manage capital.

Small Businesses & Solo Surveyors

Leasing usually makes more sense here. It minimizes upfront costs, keeps cash flow steady, and avoids large capital outlays. For many small operators, preserving liquidity is more valuable than owning equipment outright—especially if projects are variable or seasonal.

Mid-Sized Firms

Leasing gives you room to grow. You can scale your gear with new contracts, keep tech fresh, and avoid tying up credit lines. Plus, tax efficiency becomes more meaningful at this level, and predictable payments simplify planning across departments or crews.

Large Companies

Bigger firms with stronger balance sheets may prefer to buy—especially for equipment they use daily over many years. Ownership can provide long-term cost savings and balance sheet advantages. That said, even large companies lease when they want to keep tech current or offload asset depreciation.

If your business needs flexibility and cash preservation, leasing is likely the better fit. If long-term use and asset ownership are your top priorities, buying might make more sense.

Leasing is more than just an alternative to buying—it’s a strategic financing tool. It helps you stretch your budget, maximize tax deductions, and access the latest surveying equipment without tying up your cash or collateral.

If you’re eyeing a GeoMax Zoom95, Hemisphere S631—or any other premium surveying equipment—leasing could be the smartest way to get it working for your business today, not six months from now.

Need help running the numbers?

We’ll walk you through real examples based on your budget, term preferences, and tax bracket. As always, consult your accountant to verify how leasing fits into your tax strategy.

Get in touch to learn more or request a personalized lease quote.

Leasing gives you access to top-tier equipment without a massive upfront cost. It helps conserve cash flow, offers tax benefits, and gives you the flexibility to upgrade sooner—making it ideal for growing or budget-conscious firms.

The total paid over time is usually higher, but tax savings can significantly reduce the true cost. In many cases, the effective rate after write-offs is lower than traditional financing. Always check with your accountant to run the numbers for your situation.

The latest version, RTCM 3 MSM, supports all global satellite constellations and signals. It allows faster initialization, better accuracy, and is more efficient in bandwidth use. It’s also future-proof and regularly updated by a global standards body.

Yes. Many leasing plans offer early buyout options, often with interest discounts if you’ve made consistent payments for 12 months or more. You’re not locked in if your cash situation improves.

Leasing works best for firms that want flexibility, need equipment fast, plan to upgrade often, or want to optimize cash flow and tax treatment without tying up lines of credit.

Bench Mark Equipment & Supplies is your team to trust with all your surveying equipment. We have been providing high-quality surveying equipment to land surveyors, engineers, construction, airborne and resource professionals since 2002. This helps establish ourselves as the go-to team in Calgary, Canada, and the USA. Plus, we provide a wide selection of equipment, including global navigation satellite systems, RTK GPS equipment, GNSS receivers, and more. We strive to provide the highest level of customer care and service for everyone. To speak to one of our team today, call us at +1 (888) 286-3204 or email us at [email protected]

North America’s #1 supplier of land surveying equipment and instruments.